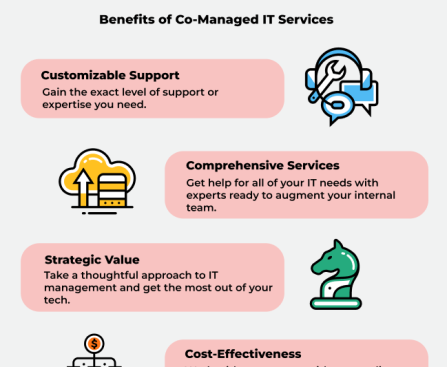

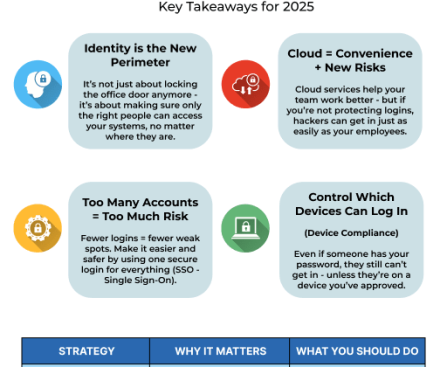

Explore the world of Co-Managed IT Services and how they benefit your company & solve key challenges. Discover why theyâre ideal for mid-sized businesses

The post Why Co-Managed IT Services Are the Right Choice for Growing Businesses appeared first on Miles IT Company.