**Apple’s Stock Increase: Perspectives from Bank of America’s Latest Investor Memo**

In a recent investor memo, Bank of America reaffirmed its “Buy” recommendation on Apple Inc. and raised its price target, reflecting positive sentiment about the company’s performance, especially due to strong sales of the iPhone 17 and its long-term possibilities in artificial intelligence (AI).

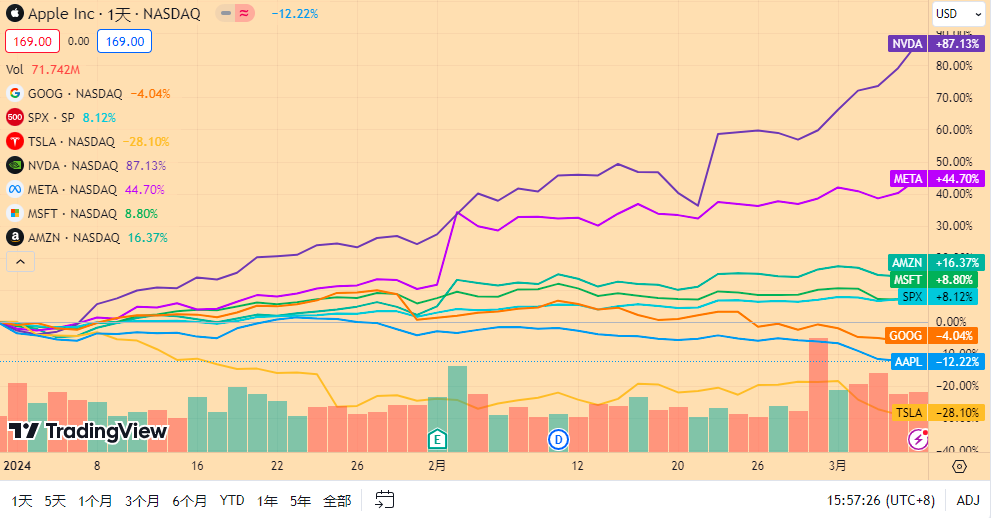

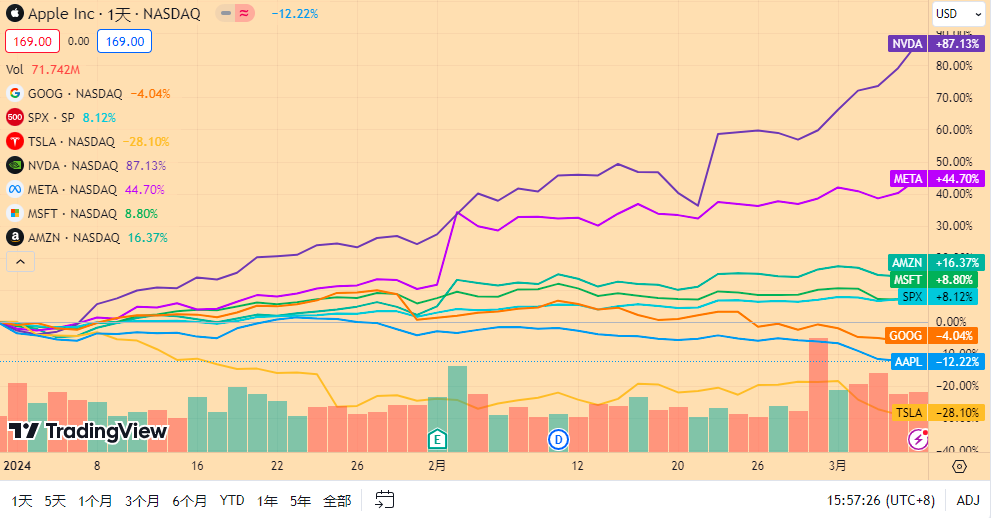

### Apple’s Stock Movement

Since April, Apple’s stock has seen an impressive increase of 56%. This rise follows an earlier memo from Bank of America Research analyst Wamsi Mohan, who had warned investors about possibly lowered expectations for the iPhone 17. Nevertheless, the most recent memo offers a more favorable perspective, particularly as the company nears its fiscal fourth-quarter earnings announcement.

Mohan has observed notable strength in the sales of the iPhone 17 Pro and Pro Max, prompting him to upwardly adjust his unit forecasts. He expects that Apple will record year-over-year revenue growth in the high single digits for the ongoing quarter.

### Updated Price Target

Bank of America has increased Apple’s stock price target from $250 to $320. This change indicates a potential gain of 19.4% from the current stock price of $268.22. The optimism is primarily fueled by stronger-than-anticipated demand for the iPhone 17 series, which has outperformed Mohan’s original estimates.

### The Impact of Artificial Intelligence

Alongside the encouraging sales data, Mohan emphasized the prospective role of AI in enhancing Apple’s future revenue avenues. He envisions that AI could improve Apple’s product portfolio, including prospective advances in AI-enhanced eyewear and internal AI robots for smart homes. However, he also recognized that AI might disrupt traditional income sources, notably in search.

### Market Situation

Despite a tough environment earlier this year, marked by a significant downturn in April due to uncertainties related to international trade policies, Apple’s stock has notably recovered. From a low of $174, the stock has managed to rebound, demonstrating resilience and investor trust.

### Summary

With Bank of America’s positive outlook, Apple seems well-equipped for ongoing growth, bolstered by strong iPhone sales and the appealing possibilities of AI integration. As the company gears up for its forthcoming earnings report, investors will be closely monitoring how these elements influence Apple’s financial outcomes.