In recent SEC filings submitted this week, Warren Buffett’s Berkshire Hathaway has once again reduced its investment in Apple. Concurrently, the firm revealed a new $350 million investment in the New York Times.

These transactions occurred in the last quarter of 2025, which also marked the conclusion of Buffett’s tenure at Berkshire. At 95, Buffett announced his retirement last year. As of January 1, Greg Abel has taken over as CEO of Berkshire.

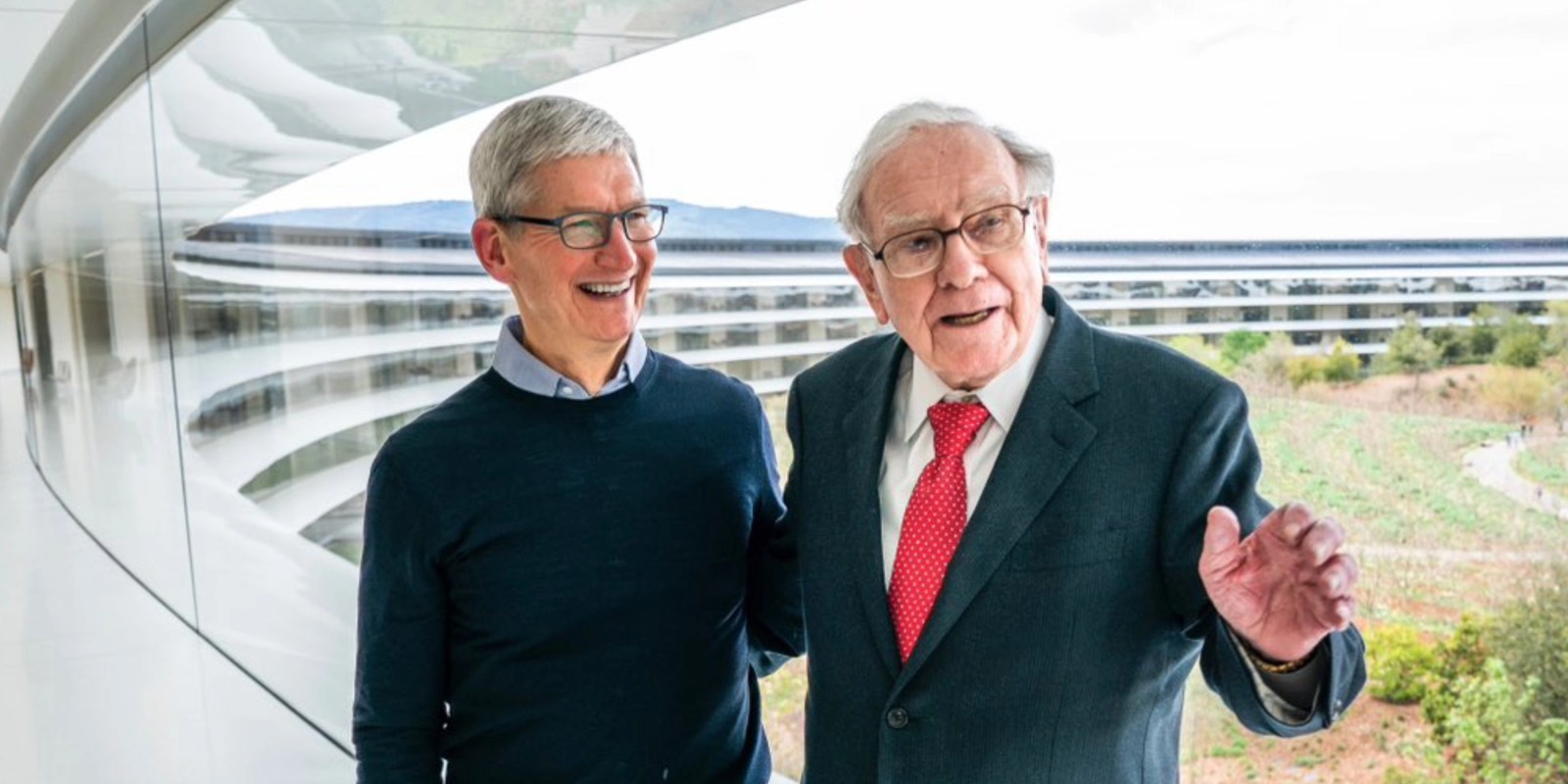

“There’s never been anyone like Warren, and many individuals, myself included, have drawn inspiration from his insight,” Tim Cook stated when Buffett declared his retirement plans. “Knowing him has been one of the greatest honors of my life. And there’s no doubt that Warren is leaving Berkshire in capable hands with Greg.”

As pointed out by Reuters, Berkshire divested 4% of its Apple shares during Q4 2025. Nevertheless, Apple remains Berkshire’s largest investment at $62 billion. “Berkshire’s filing does not specify whether the investments were made under the direction of Buffett, Abel, or portfolio manager Ted Weschler,” the report indicates.

Berkshire commenced its acquisition of Apple stock in 2016. At its zenith in 2023, Berkshire Hathaway held over 915 million shares of Apple, comprising more than 50% of the firm’s portfolio and valued at approximately $174 billion.

Buffett has diminished his holdings on several occasions over the past few years as part of a broader strategy to accumulate cash.

In an interview last year, Buffett quipped that “Tim Cook has generated more profits for Berkshire than I’ve ever done.”

Aside from decreasing its Apple investment, Berkshire reentered the newspaper sector and purchased 5.07 million shares of the New York Times. It also lowered its position in Amazon.