Quantum computing is not anticipated to surpass supercomputers by 2026 or reach an industrial level, yet investor interest in companies aiming for the quantum advantage is growing. Quantonation Ventures, a firm investing in quantum and physics-based startups, has closed its second fund with €220 million, or approximately $260 million, surpassing its first fund over twofold. Despite worries of excessive quantum hype without sufficient results causing funding issues, interest has only increased. The forecast that quantum computing will eventually crack current encryption has no definite timeline, but both governments and Big Tech are involved in the race.

Since its inception in 2018, Quantonation has witnessed the quantum technology sector mature, with technological advances and early demand from academia and industry. This development has led to new investment opportunities, as described by Quantonation partner Will Zeng. He highlighted the “picks and shovels” opportunity, with companies providing support technologies for the quantum industry. For instance, Dutch startup Qblox, known for quantum control hardware and software, received Series A funding co-led by Quantonation.

The expanding ecosystem is a reason backers are reinforcing their support for Quantonation, and why dedicated quantum funds such as QDNL and 55 North have launched. “VCs recognize the challenges of early-stage investment in this area due to specific, complex technology, new markets, and teams,” Zeng stated.

Quantonation’s strategy is to invest early; however, some quantum companies are already public, with shares increasing recently. Bloomberg reports a “quantum frenzy” partly driven by Nvidia, whose CEO Jensen Huang stated in June 2025 that “quantum computing is reaching an inflection point.”

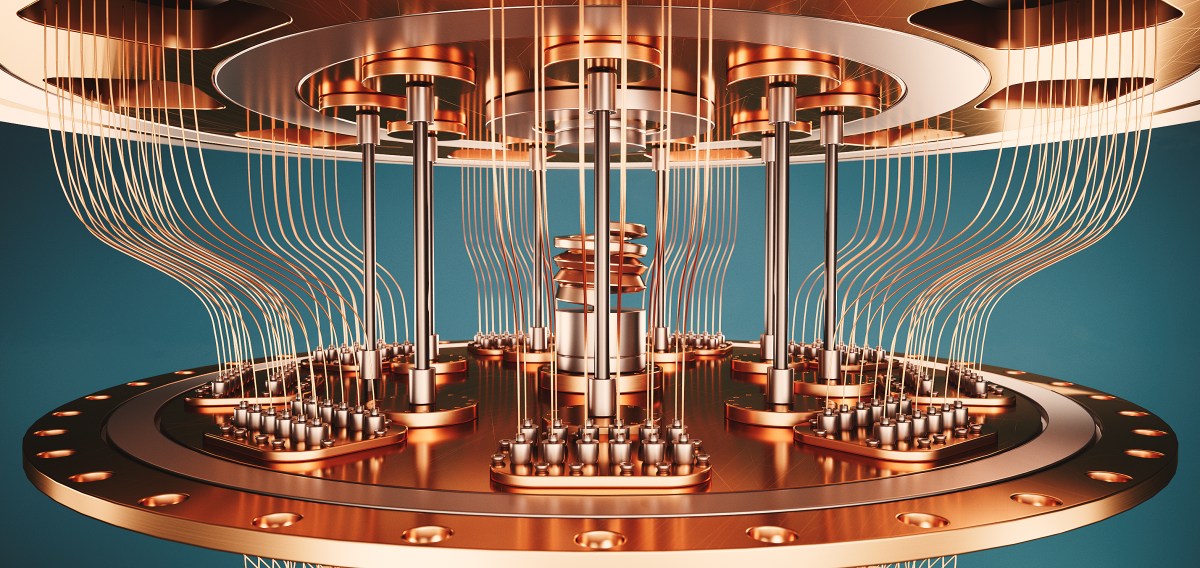

Although quantum chips haven’t yet outperformed classical computers beyond specialized benchmarks, consensus is that practical applications are approaching, from life sciences to new materials, aided by advancements in error correction. Google’s Willow chip, crucial for error correction in 2024, has yet to see a definitive architectural victor, but many small companies are participating in DARPA’s Quantum Benchmarking Initiative. Zeng believes exciting technologies remain private aside from public market enthusiasm.

Quantonation’s opportunities extend beyond quantum chips. The second fund has invested in 12 startups targeting a portfolio of around 25, encompassing software, industrial layers for quantum advantage, and additional physics-based technologies like photonics and lasers. This comprehensive thesis is supported by both existing and new investors. Major backers from the first fund, such as Vertex Holdings and Bpifrance’s Fonds National d’Amorçage 2, have returned, while new limited partners include the European Investment Fund, Grupo ACS, Novo Holdings, Planet First Partners, and Toshiba.

Quantonation’s reach is also international. With headquarters in Paris and New York City, the firm has supported French quantum companies like Pasqal and Quandela, with investments in Asia and North America continuing. “In many areas we invest, there is no clear regional leader yet, and research originates from universities worldwide,” Zeng noted.